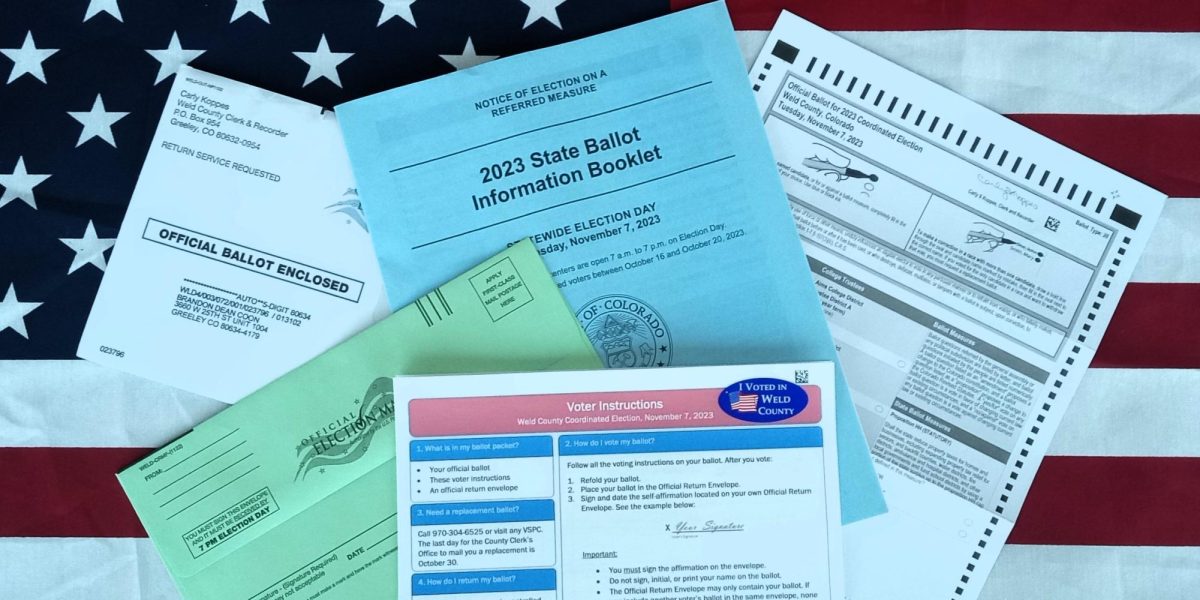

Ballots are out and Election Day (which is Tuesday, November 7) is right around the corner. For those living in the Tritown area, the 2023 ballot may hold a couple of Aims Trustee and City Council elections, but the main issues of this year’s ballot concern two propositions, Prop HH and Prop II (pronounced “eye-eye,” not the Roman numeral two). Both are legislatively referred state statutes (LRSS), meaning that they amend existing state codes, and both concern statewide taxes and revenue.

Proposition HH: The Property Tax Changes and Revenue Change Measure

Prop HH originated from our elected officials: it was approved by both the State Senate and the State House and was signed by Governor Jared Polis on May 24. The measure seeks to make various changes to state property taxes and revenue limits. Since the measure would increase state revenue, Prop HH requires voter approval under Colorado Taxpayer’s Bill of Rights (TABOR) and couldn’t be passed like any other bill. According to the Colorado Blue Book, the measure will:

- Reduce property tax rates. This proposition aims to reduce property tax rates in every corner of the state by altering the formula used to calculate them. For all property owners and homeowners, new property taxes will be determined like this:

- The property value is multiplied by the assessment rate—a statewide value, which is currently 6.765%. This gets what’s known as the assessed value.

- The assessed value is multiplied by your local property tax rate, expressed in mills (1 mill = 0.1 cents). The resulting value will be the new property tax rate.

- Limit local government property tax revenue. Prop HH will also impose a limitation on the amount of property tax revenue local governments can collect to provide homeowners some degree of predictability and control over the financial burden of their property. Some local government officials are concerned that this will hurt, their communities, as they need that tax revenue for community services and projects. To account for this, Prop HH also changes TABOR.

- Change TABOR. To make up for decreased property tax revenues, Prop HH incrementally increase the TABOR state revenue cap by 1% each year to allocate supplemental money to local governments. Passed in 1992, TABOR limits the amount of tax revenue the state of Colorado can retain and spend, and if the state government collects money over that limit, TABOR mandates that the excess revenue be returned to residents in the form of refund checks. Prop HH would allow Colorado to raise the TABOR spending limit, and the state would keep revenue that would otherwise be refunded to taxpayers. This increase has a compounding effect, which means the chances that Colorado will exceed the limit will decrease over time. While this does not mean that TABOR refunds would stop, it would reduce the amount and frequency of refunds.

Prop HH is a very complex bill that would affect every citizen in Colorado. Homeowners would see a reduction in TABOR tax refunds but should see savings in a reduction of their taxes. Property taxes will remain low enough to be affordable to new homeowners, yet local governments will not see their budgets drop drastically. Despite this ideal outcome, this measure is all about the numbers. Some local governments are skeptical that the state will provide enough money from the TABOR increase to make up for the total tax reduction, and many others don’t want to give the state more control of their local affairs. For homeowners and property owners, this bill complicates the taxes that they’re accustomed to, and with the gradual increase of the TABOR cap each year, many fear that they will ultimately end up paying more in taxes but won’t see relief in the form of a TABOR check.

Proposition II: The Tobacco and Nicotine Product Tax Revenue Measure

Prop II started as a citizen initiative and was approved by Jared Polis on June 2. Like Prop HH, Prop II requires voter approval because it would alter the TABOR cap and allow the state to retain more revenue earned from taxes on tobacco and nicotine products.

Prop II is essentially an addendum to Proposition EE, passed in 2020. Prop EE imposed a gradual increase in the statewide tax on tobacco and nicotine products, going from $0.20 per pack before the measure to an eventual $1.80 per pack in 2027. Prop EE had the double aim of reducing smoking rates and raising taxes, and the measure was passed with 68% of the vote. At the time, voters were promised that the revenue from the tax would fund preschool programs across the state.

Prop II allows Colorado to keep that promise: while the revenue indeed goes to preschool programs, TABOR still sets a cap on how much of this revenue may be kept. Prop II would change this and allow the state to retain the $23.65 million in taxes that have been collected from Prop EE, requiring this additional revenue to be spent on preschool programs.

If not passed, this money would be refunded to tobacco and nicotine sellers via a TABOR check. Furthermore, their products would see a tax reduction of 11.53%, potentially making tobacco and nicotine products cheaper for consumers. Advocates of the measure argue that Prop EE has been successful at reducing smoking rates and helping children, so we should reap all the benefits of Prop EE to expand this success. Those who don’t support the bill argue that nicotine products shouldn’t be singled out and taxed higher because they have negative health effects — it’s their choice to indulge, they argue, and they shouldn’t pay a higher financial penalty for their choice.