The Kroger-Albertsons merger is off, and it is a relief to many in the Frederick community. The Lantern has previously discussed how the merger that was tied up in legal challenges for two years would see the local Safeway sold to grocery wholesaler C&S, which industry analysts said would cause lots of problems for Safeway’s employees and customers.

This legal nightmare for the two grocery chains resulted in three lawsuits in Washington, Oregon, and Colorado. On the morning of December 11, Oregon’s court decided to grant an injunction that would delay the merger so the Federal Trade Commission would have more time to look at how the merger would impact the public.

Later that same day, Washington’s court issued a permanent injunction, meaning that the two could not merge until the FTC approved a completely different deal that would ensure better outcomes for Washington residents.

This one-two punch of legal decisions led Albertsons, the company that owns Safeway, to call off the merger with Kroger, the owner of King Soopers and City Market. Additionally, Albertsons announced that they will be suing Kroger for their breach of the merger agreement. In the suit, Albertsons accuses Kroger of torpedoing the merger by not taking action to avoid the three court cases—in a statement, the company says that Kroger was “repeatedly refusing to divest assets necessary for antitrust approval, ignoring regulators’ feedback, rejecting stronger divestiture buyers.”

At the heart of the lawsuit is a lot of money: Kroger is immediately obligated to pay Albertsons $600 million if they cause the merger to be terminated.

Kroger, naturally, is fighting back with a countersuit, alleging that it is Albertsons and not them that are terminating the agreement and are acting in bad faith. “Kroger refutes these allegations in the strongest possible terms, especially in light of Albertsons’ repeated intentional material breaches and interference throughout the merger process,” the company said in a statement. “This is clearly an attempt to deflect responsibility following Kroger’s written notification of Albertsons’ multiple breaches of the agreement and to seek payment of the merger’s break fee, to which they are not entitled.”

But why are these two companies turning against each other instead of just waiting to see what the FTC has to say? After all, Donald Trump has previously supported the merger and will nominate a new FTC head in January that would likely let the merger move forward.

There are two answers: timing, and Colorado.

Let’s start with the Colorado lawsuit issued by Colorado Attorney General Phil Weiser. While both Kroger and Albertsons argued that the merger would benefit consumers, Weiser argued that it would eliminate all grocery competition in many small mountain and plains communities.

According to FOX 31, “Weiser, who took legal action to stop the merger, said the merger would have been bad for Colorado farmers, workers, and consumers.”

But if Weiser’s suit was about blocking the merger, shouldn’t the lawsuit be dismissed since the two companies aren’t merging anymore? Well, the lawsuit was about more than just blocking the merger: Weiser’s antitrust lawsuit also alleges that Kroger and Albertsons have already engaged in illegal collusion before the merger. Weiser claims that when King Soopers and City Market workers went on strike in January 2022, Albertsons and Safeway stores pledged not to hire striking workers nor would they permanently transfer pharmacy prescriptions from Kroger stores to theirs. This anticompetitive behavior is illegal and, if the Colorado case finds the companies guilty, would levy heavy fines against both grocers.

Besides opening themselves up to more legal trouble (and money spent on lawyers), Albertsons likely feels like they are in a different business environment going into 2025 than they were in 2022 when they initially agreed to the merger. While Albertsons was struggling as a company at the start of the pandemic, it is a strong financial position if the $4 billion dividend they paid to their shareholders earlier this year is any indication. Moreover, grocery prices have started to stabilize, so Albertsons can better compete against Kroger’s typically lower prices. Albertsons has also increased their digital sales by 24%, more than any other retailer.

Locals seem to be happy that the merger isn’t moving forward. Jill McCormick, a working mom who attends the local Safeway about two times a week, said, “I’m pleased because I think having a variety of stores in a small town gives more options for the citizens to shop based on price and customer service, all within the same relative distance.”

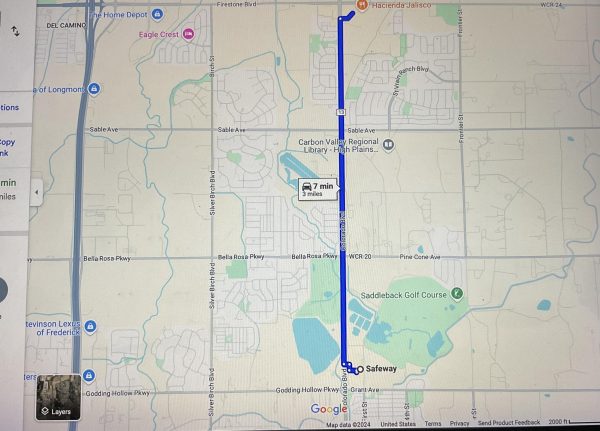

Junior Jenna Johnston commented on how, “I typically go to King Soopers for weekly grocery shopping, but I do go to Safeway if I ever need to pick up something after school… having one [Safeway] close to school makes it so easy and convenient to go grocery shopping when I need to.”

So does this mean our Safeway is safe? Not at all—in fact, it may be more imperiled than ever.

If the merger would have gone through, then the Firestone Safeway would have been sold to C&S Wholesalers, a group that the Washington court decision decided was not yet ready to enter the grocery business. The sale was necessary because the FTC would never allow one company to control such a large percentage of the grocery market, but the stores were not chosen at random: Kroger chose the most profitable stores to keep and put the rest on the C&S sale list. This means that our local Safeway has already been identified as a store to put on a chopping block.

While C&S was predicted to raise prices, change product availability, and see an end to the Starbucks kiosk, there were two things it couldn’t do according to the merger agreement: cut staff or close the story. Really, the worry about the Safeway altogether closing was if C&S sold it to another company that would strip it for parts, as they have done with grocery chains they’ve acquired in the past. Similarly, Kroger-Albertsons wouldn’t be able to hold mass layoffs or close stores for nearly a decade without government approval.

These guardrails are gone now, so Albertsons is free to cut staff or close down the Firestone Safeway at any time.

This is in no way saying that all hope is lost for our local grocer. The Washington lawsuit, which was asked directly by prosecuters to determine if either Kroger or Albertson would go bankrupt without the merger, said that Albertsons needs to invest in improving many of their locations to stay competitive, and Albertsons has recently committed to improve and upgrade their stores and products across all their brands, including Safeway.

So Safeway is safe for now, but for how long?